This section is suitable for Grades 10 through to 12.

Depreciation rate. This is the percentage rate that we use to depreciate our assets.

Examine the table above and try and notice the patterns. In particular, note that the depreciation each year decreases, as long as the cost price stay the same.

Notice how, at the end of this second financial year, Accumulated Depreciation now contains the value of both years' depreciation. We continue this same procedure every year for the life of the asset, until...

To see how Depreciation and Accumulated Depreciation are handled when an asset is sold, look for a post on Asset Disposal.

Depreciation

Depreciatiarerrrrrrrrrrrrrrr is the loss of value of an asset over time due to wear and tear. This means that it only refers to the loss in value of an asset from day-to-day use, and not from a loss in value due to other causes. So, for example, if someone blows up the business's car, that decrease in value is not depreciation.

Depreciation is an expense, because it is a decrease in equity due to the decrease in value of an asset. Unlike most other expenses, depreciation does not involve any money being paid out, and as such is called an imputed expense.

There are two methods we use to calculate depreciation. Regardless of which method we use, we must use a fixed depreciation percentage rate for the life of the asset.

Definitions

Cost Price (or Historic Cost Price). This is the amount that the business actually paid for the asset when they bought it. This is the value that the asset is recorded at in the asset's ledger account in the General Ledger

Accumulated Depreciation. This is the total depreciation of the asset over its whole life.

Book value or Carrying Value. This is the (theoretical) value of the asset to the business. It's calculated as:

Book value = Cost price - Accumulated Depreciation

Depreciation rate. This is the percentage rate that we use to depreciate our assets.

Methods of Calculating Depreciation

The Straight-line Method

When we use the straight-line method to calculate depreciation, we calculate depreciation for each year using the following formula:

Depreciation for the year = Cost Price x Depreciation Rate.

For example, if we purchased a vehicle on the first day of 2001 for R250 000, and the depreciation rate is 20% p.a., the depreciation each year will be 250 000 x 0.2 = R50 000. We can show the value of this asset over the first ten years of its life as follows:

It's easy to see that the carrying value decreases steadily by R50 000 each year... until it should hit zero. As you'll see in the section below on salvage value, by convention we never let an asset depreciate to zero. Instead we leave it with a book value of R1. This means that at the end of 2005, the book value of the vehicle is R1, and we don't depreciate it after this.

Note that when we use the straight-line method, depreciation will be the same every year over the lifespan of the asset.

|

| Value of a vehicle that is depreciated on the straight line value. Note how it has a default salvage value of R1. |

Note that when we use the straight-line method, depreciation will be the same every year over the lifespan of the asset.

The Diminishing Balance Method

For this method, depreciation is calculated using the following method:

Depreciation for the year = Book Value x Depreciation Rate.

For the first year in an asset's life, the depreciation calculated under either method is the same. It's only after that there is a difference.

For example, suppose that a vehicle was purchased on the first day of 2001 for R250 000, and the depreciation rate is 20% p.a. If we calculate the depreciation using the diminishing balance method, the following table shows the depreciation and accumulated depreciation for the first 10 years (we assume that the financial year-end is 31 December):

|

| Value of an asset over 10 years, if it's depreciated using the diminishing balance method. |

Recording Depreciation

Depreciation is recorded in the General Journal, which is then posted through to the General Ledger. It is very important to remember that depreciation is an imputed expense, and so no money is paid or owed.

It is also important to remember that according to the Historic Cost Principle, we record the value of assets like Equipment and Vehicles at their cost price. Because of this, we "store" the total depreciation in an account called Accumulated Depreciation. This account can be thought of as a negative asset. It increases on the credit side, and represents the total decrease in value of the asset over time.

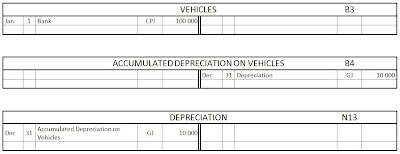

To illustrate this using an example, let's suppose that vehicles worth R100 000 are bought on 1 January 2010, the start of the financial year. If the vehicles are bought for cash, our first entries will be:

|

| Buying equipment for cash |

At the end of the year, we will need to process the depreciation. For this example, depreciation on vehicles is calculated at 10% p.a. on the diminishing balance. This will be recorded using the Accumulated Depreciation on Vehicles account and the Depreciation account. Notice how the Vehicles account remains unaffected:

|

| Recording depreciation |

At the end of the year, Vehicles and Accumulated Depreciation on Vehicles will have balances to be carried down, and Depreciation will be closed off. This will result in the following year-end situation (I've done the balancing transactions in blue)

At the end of the next year, we will need to calculate depreciation again. Because we are calculating depreciating using the diminishing balance method, we need to work out the book value first. We do this by taking the cost price minus accumulated depreciation, which would give us R90 000. 10% of this gives us our depreciation for the year, which is R9 000. The depreciation entry is marked in green.

|

| Balances at the end of the year |

|

| Depreciation for the second year |

Notice how, at the end of this second financial year, Accumulated Depreciation now contains the value of both years' depreciation. We continue this same procedure every year for the life of the asset, until...

Salvage or Scrap Value

If we use the straight-line method of depreciation, the book value of the asset will eventually reach zero. By convention, the minimum book value we will give an asset is R1. This means that an asset can never have a book value of zero! Note that this is a little detail that seems to like making its way into exams.

It is reasonable that, at the end of the life of an asset, it will be expected have some value. In this case, we call that value the salvage or scrap value of the asset.

This idea of an asset having a value of R1 can be a little strange to swallow. If we have a car that has depreciated down to R1, but we are still using it, and we know that we can sell it for R10 000 even though it's old, it just seems strange. This is where, amongst other things, the GAAP concept of prudence is important. We can't revalue the vehicle to R10 000 just because we think that we'll get that much money for it, because we haven't actually received that money yet. It's more prudent to record it at R1, and if we sell it for more, that's a bonus!

This idea of an asset having a value of R1 can be a little strange to swallow. If we have a car that has depreciated down to R1, but we are still using it, and we know that we can sell it for R10 000 even though it's old, it just seems strange. This is where, amongst other things, the GAAP concept of prudence is important. We can't revalue the vehicle to R10 000 just because we think that we'll get that much money for it, because we haven't actually received that money yet. It's more prudent to record it at R1, and if we sell it for more, that's a bonus!

Depreciation for part of the year (Grade 11 and 12)

Depreciation for part of the year is not part of the Grade 10 syllabus (I think).

To calculate the depreciation for part of the year (for example, 7 months), we first calculate the full depreciation for the year, using the relevant method, and then multiply our answer by 7/12.

In general, if we have to calculate depreciation for n months in the year, we multiply our year's depreciation by n/12.

This is particularly important when an asset is bought or sold during the year, and must therefore only be depreciated for part of the year.

To see how Depreciation and Accumulated Depreciation are handled when an asset is sold, look for a post on Asset Disposal.

No comments:

Post a Comment